You have ever pondered how to organise your investments to meet your financial objectives? Or how to figure out how much money you should invest each month? For precise investment planning, a SIP (Systematic Investment Plan) calculator can be useful. Making informed financial decisions can be aided by using a SIP calculator in India, where mutual funds and SIPs are widely used. Let’s examine how to use a SIP calculator for precise investment planning successfully.

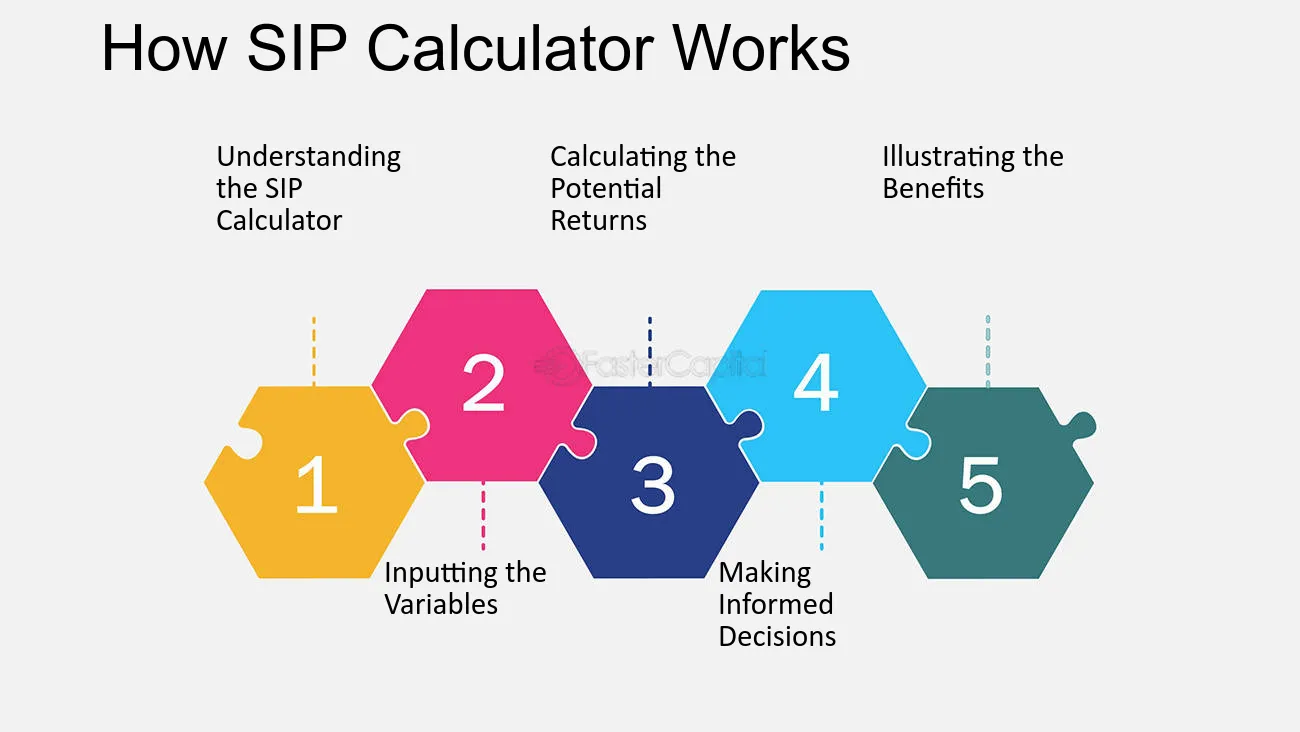

- Understand what an SIP calculator is

An SIP calculator is an online tool that assists investors in determining the future value of their investments. The monthly investment amount, the expected rate of return, and the investment duration are some details you can input to see how your investments will be in the future. When it comes to the use of the SIP calculator, it is essential to know the fundamentals to apply it properly to get the right investment planning.

- Input accurate monthly investment amount.

The initial input required when using an SIP calculator is the amount that you wish to invest every month. This amount may depend on your objectives and financial capabilities. Make sure that the amount you enter is one that you will be able to afford in the long run. This helps in arriving at the right estimates for the growth of your investment.

- Set a realistic rate of return

The rate of return is one of the significant factors that influence the growth of your investments. It is important to understand that different mutual funds have different rates of return. Employ the SIP calculator to enter the realistic rate of return that has been observed in the past and the current market situation. This assists in formulating reasonable financial objectives that are within your reach and not over-ambitious.

- Choose the right investment duration

The length of time that you invest affects the final sum that you earn greatly. The best way to understand how different durations work is to try them out on the SIP calculator. Long-term investments usually provide higher returns because of the compounding effect. This assists you in selecting an ideal duration that meets your financial goals.

- Utilise the SIP calculator step-up feature

Most SIP calculators have a step-up provision where you can raise your monthly contribution at set intervals. This can go a long way in improving your returns in the long run. You can also use the SIP calculator step-up feature to know about future changes such as a raise in your salary or an increase in your income. This helps to ensure that your investments increase in proportion to your ability to fund them.

- Compare different mutual funds.

An SIP calculator also enables an investor to compare the probable returns of different mutual funds. Enter the same investment amount and time frame for different funds to determine which of them provides the highest returns. It assists you in selecting the right fund for your needs and objectives.

- Plan for multiple financial goals

You may have different financial objectives like purchasing a home, paying for your child’s college, or planning for retirement. It is recommended to use the SIP calculator to plan for each of these goals individually. Enter the amount of money and time required for each goal and you will find out how much you need to invest monthly. This is useful in developing an overall investment strategy that encompasses all your financial goals.

- Factor in inflation

Inflation is another factor that would reduce the value of the returns in terms of purchasing power. It is also important to note the level of inflation when using the SIP calculator. Undefined This is helpful in setting financial targets that are more achievable and making changes where necessary on the investment plan.

- Reinvest dividends

Reinvesting dividends can enhance the growth of your investments. Use the SIP calculator to see the impact of reinvesting dividends on your returns. This strategy ensures that you maximise the potential growth of your investments over time.

- Monitor your investments regularly

It is important to keep track of your investments in order to plan for your investments effectively. It is wise to use the SIP calculator to review your investments and make adjustments, if necessary, from time to time. This keeps you in check with your financial objectives and enables you to make sound decisions in line with market trends.

- Stay consistent with your investments

It is important to be as consistent as possible if one wants to get the most out of SIPs. Rupee cost averaging is achieved by investing a fixed amount at fixed intervals irrespective of the market conditions of the share. Check out the SIP calculator to know how regular investments can build up over the years. Being consistent helps you get the best out of your SIP investments.

- Avoid emotional investing

It is always dangerous to invest emotionally. Make a disciplined investment plan with the help of the SIP calculator and do not deviate from it. Do not make decisions based on short-term movements up or down in the market. Investment planning using an SIP calculator ensures that you remain on track to achieve your financial objectives and get the best results.

- Adjust for changes in financial situation.

It may take some time for your financial status to improve due to promotions that lead to higher wages, incentives, or other expenses. Adjust your investment amounts as stated below using the SIP calculator. This flexibility enables your investment plan to always reflect your current status or your ability to invest.

- Utilise online resources for better planning

There are numerous online resources and utilities that can be used in conjunction with the SIP calculator to improve your budgeting. They can be used to acquire information on the market trends, performance of the funds, and investment strategies. When used in conjunction with the SIP calculator, these resources will allow you to make the best choices for your investments and yield the highest possible results.

- Plan for tax efficiency

Tax efficiency is another factor that a potential investor needs to consider while developing an investment strategy. The SIP calculator also helps in determining the taxes that are involved in the investment transactions. It is wise to invest in tax-saving mutual funds such as ELSS (Equity Linked Savings Scheme) as the investment made under this scheme qualifies for deductions under section 80C of the Income Tax Act. This assists you in the way that your tax rates will be reduced hence increasing your returns.

Conclusion

To maximise the potential of your investments and achieve your financial objectives, it is highly advisable to apply an SIP calculator efficiently. If you get basic knowledge about them, set proper financial goals, select the proper time period of investment, and use the facilities like the step-up option, then you can invest properly which can fulfill your financial dreams. Moreover, factors such as inflation, tax efficiency, and compounding can be taken into consideration to further increase the return rates. Being consistent, not getting emotionally attached to the investments, and using online tools can be used in parallel with the SIP calculator to accurately capture the right investment planning. By following these steps, it becomes easier to get the best of SIP investments and ensure a healthy financial future.

Leave a Reply