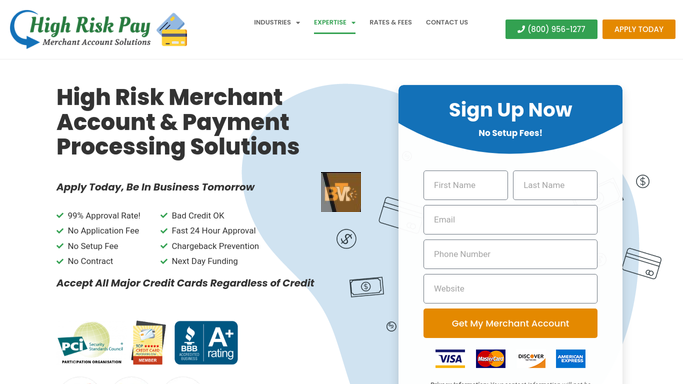

When running a business labeled as high-risk, finding reliable payment processing solutions can be challenging. HighRiskPay.com offers the perfect solution for these businesses with its high-risk merchant accounts. With years of experience and expertise in handling high-risk industries, HighRiskPay.com ensures that businesses can process transactions securely, efficiently, and without hassle.

What is a High-Risk Merchant Account?

A high-risk merchant account is a type of bank account specifically designed for businesses that operate in industries with a higher risk of chargebacks, fraud, or legal issues. Some industries, like online gaming, travel, or adult entertainment, are often considered high-risk by banks and credit card processors. This designation can make it difficult for businesses in these sectors to secure traditional merchant accounts.

High-risk merchant accounts, like those provided by HighRiskPay.com, are tailored to the unique challenges these businesses face. They allow companies to process credit card transactions securely while minimizing the risks of chargebacks or account freezes. With specialized features like fraud protection and chargeback mitigation, a high-risk merchant account is essential for businesses that don’t fit into the “low-risk” category.

Who Needs a High-Risk Merchant Account?

Businesses that fall into high-risk categories are often required to obtain a high-risk merchant account. These include industries like:

- Adult entertainment

- E-commerce stores with high refund rates

- Subscription-based services

- Travel agencies

- Health and wellness products (such as supplements)

Any business that regularly faces a higher likelihood of chargebacks or fraud might be labeled as high-risk. This label isn’t a reflection of the business’s legitimacy but rather the nature of its transactions or clientele. HighRiskPay.com specializes in helping these businesses by offering reliable and secure payment solutions that enable smooth financial operations.

How to Get a High-Risk Merchant Account at HighRiskPay.com

Acquiring a high-risk merchant account from HighRiskPay.com is simple and straightforward. The application process is designed to ensure that businesses can quickly get the account they need without unnecessary delays.

Fast Approval Process

One of the standout features of HighRiskPay.com is its fast approval process. Unlike traditional banks, which may take weeks or months to approve high-risk businesses, HighRiskPay.com offers rapid approval, often within 24 to 48 hours. This quick turnaround allows businesses to start accepting payments almost immediately after their application is approved, ensuring minimal disruption to their operations.

No Hidden Fees

Many high-risk merchant account providers are notorious for tacking on hidden fees that can significantly inflate costs. HighRiskPay.com prides itself on transparency. There are no surprise charges or hidden fees, making it easier for businesses to manage their financials effectively. Every fee is clearly outlined, so businesses can plan their costs with confidence.

Chargeback Protection

One of the major challenges for high-risk businesses is dealing with chargebacks. Chargebacks can not only result in lost revenue but can also lead to additional penalties or even the termination of a merchant account. HighRiskPay.com offers robust chargeback protection tools to help businesses fight chargebacks and reduce their occurrence. These tools include monitoring systems that flag potentially fraudulent transactions and automated alerts to help businesses address issues before they escalate.

Benefits of Using HighRiskPay.com

HighRiskPay.com provides a range of benefits that make it a preferred choice for high-risk businesses. Here are some key advantages:

- Specialization in High-Risk Industries: Unlike traditional banks or generic payment processors, HighRiskPay.com understands the unique needs of high-risk businesses. Their experience allows them to offer tailored solutions that directly address the specific challenges faced by these industries.

- Global Reach: HighRiskPay.com supports businesses worldwide, enabling international payments without hassle. This is particularly beneficial for high-risk industries that often have a global customer base.

- High Approval Rate: With a high approval rate for high-risk businesses, HighRiskPay.com is known for its flexibility in accommodating companies that other financial institutions may reject.

- Customizable Solutions: Depending on the nature of the business, HighRiskPay.com offers customizable payment processing solutions, ensuring that each business gets exactly what they need for smooth operations.

Common Concerns About High-Risk Merchant Accounts

When considering a high-risk merchant account, businesses often have concerns about fees, terms, and potential limitations. HighRiskPay.com addresses these concerns with clear communication and transparent policies.

Higher Fees for High-Risk Businesses

One common concern about high-risk merchant accounts is the higher fees associated with them. Because these businesses are more prone to chargebacks and fraud, payment processors charge higher fees to mitigate their risk. While it’s true that high-risk merchant accounts often come with higher transaction fees compared to standard accounts, the extra cost is offset by the increased protection and flexibility provided.

What is a High-Risk Merchant Account?

As mentioned earlier, a high-risk merchant account is designed for businesses that operate in industries with higher-than-normal risk factors. These factors could include a higher likelihood of fraud, chargebacks, or other issues that can impact the financial institution providing the account.

Why Do Some Businesses Need a High-Risk Merchant Account?

Some businesses need a high-risk merchant account because their industry is considered inherently risky by banks and payment processors. Whether it’s because of the nature of the products they sell, the clientele they serve, or their transaction patterns, these businesses require specialized payment solutions to continue operating smoothly. For example, e-commerce stores that sell high-ticket items or health-related products might see more chargebacks, making them a high-risk target for payment providers.

Benefits of Using HighRiskPay.com

As previously mentioned, HighRiskPay.com offers a variety of benefits for high-risk businesses. These include quick approvals, no hidden fees, and robust chargeback protection, which are essential for businesses in high-risk industries. In addition, their extensive experience with high-risk merchants ensures that your business will receive the best possible service tailored to its unique needs.

Can Any Business Apply?

Yes, any business can apply for a high-risk merchant account at HighRiskPay.com, but approval is subject to the risk assessment conducted by the company. HighRiskPay.com specializes in high-risk industries, which means that businesses typically rejected by traditional banks have a much higher chance of approval here. The application process is simple, and with the fast approval times offered by HighRiskPay.com, businesses can get their merchant accounts up and running quickly.

The Bottom Line

Securing a high-risk merchant account at HighRiskPay.com is essential for businesses operating in high-risk industries. With their specialized solutions, fast approval process, transparent fees, and chargeback protection, HighRiskPay.com provides everything a high-risk business needs to succeed. By choosing HighRiskPay.com, businesses can process payments securely, reduce the risks associated with chargebacks, and focus on growth without worrying about their financial infrastructure. Whether you’re running a subscription service, e-commerce store, or a travel agency, HighRiskPay.com has the expertise and resources to keep your transactions smooth and your business thriving.

In conclusion, if you’re a high-risk business seeking reliable and efficient payment processing solutions, HighRiskPay.com offers the perfect blend of security, speed, and transparency. Apply for a high-risk merchant account today and experience the benefits that come with partnering with an industry leader in high-risk payment processing.

Leave a Reply